- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Unsecured Business Loans | Financing Solution

Unsecured business loans; Does your small business qualify?

Unlike business loans secured by collateral, unsecured business loans are approved based on credit rating and financial history. If your business suffers from poor credit and/or limited financial history you should consider a business cash advance as an alternative to an unsecured business loan.

Unsecured Loans For Small Businesses

In contrast to large companies that have equity in assets, small businesses with little assets and no property depend on loan options that are unsecured. In addition to missing collateral, most entrepreneurs that develop small businesses struggle in early stages creating a less than perfect financial history making approval for an unsecured business loan or line of credit unlikely. For this reason an unsecured business cash advance tends to be a more suitable option for small businesses.

Cash Advance as an Unsecured Business Loan Alternative

Business cash advances offer the following benefits not available through unsecured loans:

- Flexible repayment options!

- Unsecured, no collateral necessary!

- Bad credit not an issue!

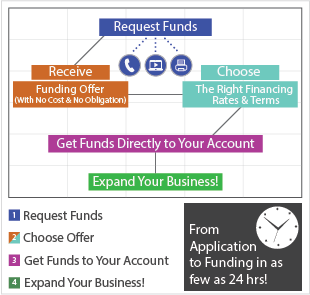

Our simple online application takes only a few minutes to complete, and we can approve your business for an unsecured cash advance in less than 24 hours.

Stop applying for unsecured business loans and get financing quickly!

Apply online now or call us toll free

1-888-878-6250 (1-888-UpTo-250K)