- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Is a Secured Business Loan the Best Financing Option Available?

A secured business loan may be the only financing available to new businesses in need of start up capital. But for existing businesses looking for additional financing or a working capital, a secured business loan is not always the best option. Financing the operation and growth of your business does not need to be tied to your assets. A secured loan puts your personal and business assets at risk. Businesses can qualify for unsecured financing with a business cash advance up to $250,000 and avoid risks associated with a secured business loan.

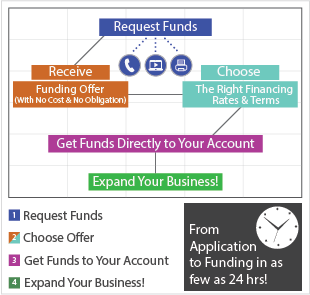

Applying for a business cash advance is simple, with few requirements and a fast application process. Your business can be approved in less than 24 hours and funded in less than a week without even submitting a business plan!

Secured Business Loans Vs. Unsecured Cash Advances!

Since business cash advances are based on future credit card sales, no security in the form of collateral is required. Because the cash advance is not a loan, credit rating and collateral is not considered for approval. The unsecured nature of the business cash advance means less risk to you than secured business loans offered through the bank.

Requirements are minimal:

- Your business is registered in the United States

- You process $2,500 or more in credit card sales

- Your business already exists (This is not available to start-ups)

Over 95% of businesses that meet these requirements are approved for an unsecured business cash advance.

Don't risk your assets with secured business loans! Apply for unsecured financing today.

Apply online now or call us toll free 1-888-878-6250 (1-888-UpTo-250K)