- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Are You Looking for a Minority Business Loan?

Minority business loans were established to help women and minority business owners develop their businesses. For start up businesses a minority loan may be the best option. For established businesses in need of working capital, the long approval process and strict requirements make loans a less attractive option. Minority loans in general are reserved for new ventures. Lenders even those providing special consideration to minorities don't favor existing businesses in need of more working capital. Established minority owned businesses can get financing while avoiding the hassles of business loans with an unsecured business cash advance.

Minority or Not... It's Better Than a Business Loan!

Since business cash advances are based on future credit card sales, no collateral is required to secure them, and unlike minority business loans, there is no need for a business plan and funding is not limited to a small predetermined quota.

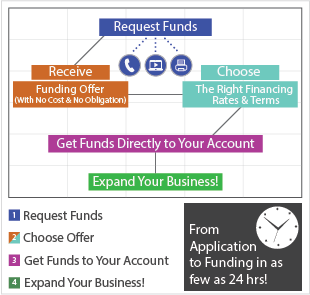

In addition to the simple approval process and minimal requirements, cash advances offer businesses flexible repayment options and can be approved in less than 24 hours.

Any established business that meets the following requirements may be eligible:

- Your business is registered in the United States

- You process $2,500 or more in credit card sales

- Your business already exists (This is not available to start-ups)

Approximately 95% of businesses are approved for up to $250,000.

Special consideration from minority business loan lenders is not your only option!

Apply online now or call us toll free 1-888-878-6250 (1-888-UpTo-250K)