- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Trucking Business Financing

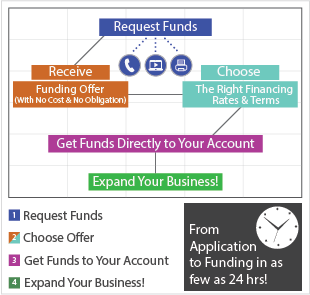

Trucking business financing often takes the shape of a bank loan. But if you�ve suffered bad credit, don�t want to or can�t put your rig up for collateral, where can you turn for an alternative? You need a lender who specializes in small business financing solutions designed to make it easier for you to get the funds you need. Banks base their approval on your credit rating, financial statements, collateral, etc. But the time you spend sitting in a traditional lending institution is time away from delivering your load and picking up the next. You don't need to keep �banker's hours� to get the funds you need. Don�t put off maintenance and upgrades. The application takes only a few minutes for the cash you need to use as you see fit. You can be approved in 24 hours or less. Payments are flexible and based on your future income. If your revenue drops then your payments decrease.

| FastUpFront | Lending Institutions | |

| Good Credit | X | + |

| Collateral | X | + |

| Stable Financials & Tax records | X Last 3-4 mo. Bank statements are all you need |

+ |

| Application | Short and easy | Long and complicated |

| Business Plan | X | + |

| Payments | Flexible | Fixed |

In 24 hours or less you can be approved for the financing you need.

Apply now online for a fast, easy business line of credit or call our experts toll free

at 1-888-878-6250.