- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

SBA (Small Business Administration Loan)

The Small Business Administration (SBA) loan program provides loans for the purchase of fixed assets such as real estate and machinery. But what to you do if the traditional SBA loan is not for you? You need a small business financing especially suited for an enterprise like yours. The SBA loan requires the business owner put in a minimum of 10%, a conventional lender (bank) to add 50%, and a Certified Development Company pays in the remaining 40%. For small businesses this means you not only need to come up with the minimum payment, but you also need to apply and qualify for the lender and CDC contributions.

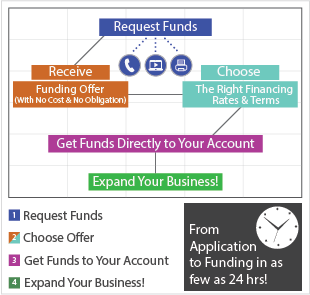

Wish there was a faster, easier way for your small businesses to get the funds it needs? There is an alternative! The application process is quick and easy with no money down. Poor credit or no credit is not a problem. You decide how to use your money, when and on what. Payments are flexible, based on future sales. If your sales decrease, your payments are less.

| FUF | SBA Loans | |

| Good Credit | X | 10% Down |

| Collateral | X | + |

| Stable Financials & Tax records | X Last 3-4 mo. Bank statements are all you need |

+ |

| Application | Short and easy | Long and complicated |

| Business Plan | X | + |

| Payments | Flexible | Fixed |

In 24 hours or less you can be approved for the financing you need.

Apply now online for a fast, easy business line of credit or call our experts toll free

at 1-888-878-6250.