- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Seasonal Business Cash Advance up to $250,000

Does your Seasonal Business require financing or a loan?

We offer up to $250,000 unsecured cash advance for seasonal businesses!

Climate, geography and other factors may make your businesses a �seasonal businesses�. Seasonal businesses can suffer from either low sales seasons or complete shut-downs.

Obtaining financing in the form of a bank loan can be challenge as financial institutions and banks consider seasonal businesses to be high risk and assume fixed loan repayments to be impossible during the off-season. However, if your business accepts credit cards, you can be approved for a business cash advance of up to $250,000 against future sales.

Why is a Cash Advance preferred for Seasonal Business?

- No fixed repayment schedule frees seasonal businesses from cash flow issues in the off seasons

- Qualifying is not based on your last year of business. (this can be extremely important if your last year suffered due to climate or other irregular factors)

- Our application process is fast and does not require any personal guarantee, credit assessment or collateral.

- Your unsecured cash advance can be used for anything your business needs.

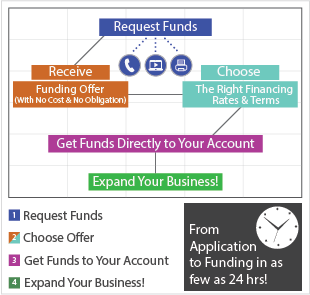

If you process at least $2500 in credit card invoices per month you can apply for an unsecured business cash advance of up to $250,000. Get started online now, or call 1-888-UpTo-250K