Just when you thought it was hard enough to remain creditworthy as a small business owner or solopreneur, a new report published at American Banker highlights a potential banking trend that could change the way credit is built and maintained. According to the report that discusses nine trends affecting risk software in the banking industry, some banks have begun to consider additional data when determining a person’s creditworthiness.

So what exactly is this “additional data”? From the report:

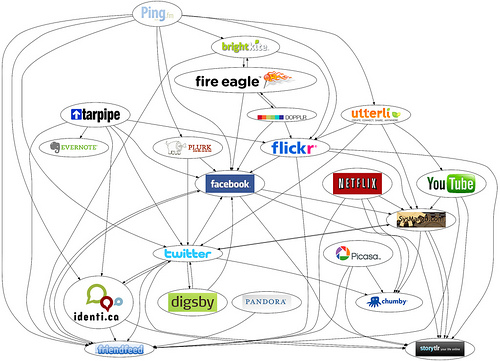

One idea banks are toying with is that of incorporating social media data into assessments of credit risk, for instance, by considering the credit scores of a person’s friends in addition to that person’s own score. However, information posted on social media is not always 100% accurate. Under the Fair Credit Reporting Act, banks have to be able to verify customer data. “If I went on LinkedIn and said I have a PhD in astrophysics, which is not true, a number of people might comment on that, but the bank would still need to check that,” Jennings points out.

Though the use of social media to assess credit risk is still just in the realm of theory for banks, some small financial institutions, such as online microlender Lenddo, have already begun to experiment with the data.

While visions of social credit snobbery immediately fill my mind: “Friends with you?! Sorry, buddy, you’re credit’s too low!” It does raise an interesting question of how our social circles can relate to our ability to maintain good credit, and it may make you think a bit before accepting that new friend request.