Thinking of selling your business? Hold on, and wipe those dollar signs out of your eyes. There are several factors that can affect the value of a business, and if your company isn’t up to snuff then it can look to potential buyers like the leftovers in a Walmart clearance bin. So before you offer your business up for sale, you might want to consider where it is holding in the following ten areas:

1. Your business has little cash flow. There can be many reasons why your business would come up short in the cash flow department. You invested heavily in equipment or inventory, or you have piles of outstanding customer invoices. In this case, you may be showing revenue on your income statement, but the truth is you are cash poor. You may also be experiencing a decline in sales. Either way it puts a negative mark on your business and it will adversely affect the sales price.

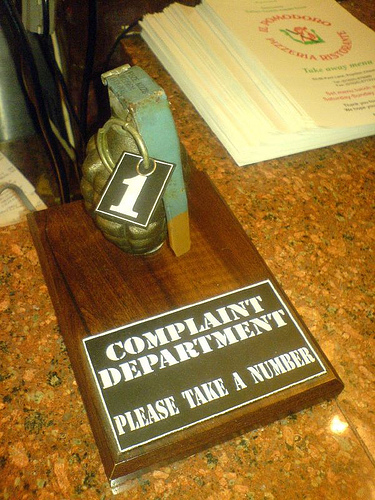

2. Your business has a poor reputation. In the category of intangible assets, your business’ reputation comes out tops- especially these days when customers are more particular about where they spend their money. If your brand is well developed and highly regarded, you’ll be more likely to cash in. But if you are being hounded by customer complaints, it doesn’t bode well for your sales price.

3. Your business is in a no-growth industry. If industry trends aren’t looking so rosy then it’s not a good sign for your sales price.

4. You did not build up a loyal customer base. Another biggie when it comes to intangible assets is building a loyal network of customers. Even more valuable is cultivating a data base of information about your active patrons. If, however, you have no connection to your customers and revenues have been spotty, then your sales price will take a nose dive.

5. Your financial records are a mess. If you have not made an effort to ensure that your financial accounting is clear and accurate and that necessary documents are easily accessible then you may have a hard time proving your businesses past performance, it also gives off a bad smelling air of unprofessionalism.

6. Your business has a poor credit profile. One of the things that potential buyers will check out before deciding to purchase a business, is the business’ credit profile. With this number, buyers can get an idea about the general health of the business.

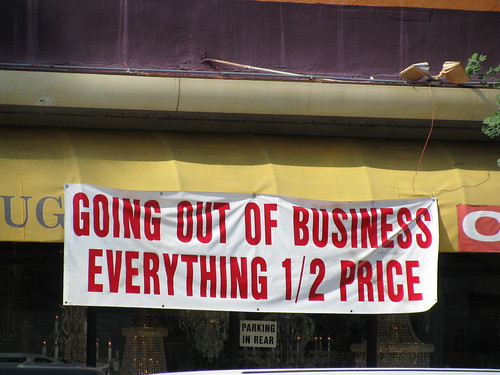

7. The location is bad. If the city, town, or even the street are not considered safe or are economically depressed then it will impact the value of your business. This is especially true when other, nearby businesses are leaving the area. Alternatively, the area in general may be ok, but it is not suitable to your particular business.

8. You have a poor sales history. If sales have been down, unless it is a predictable seasonal decline, then it can negatively impact the value of the business and make it less attractive to potential buyers.

9. You have no real niche. In many industries, especially those that have a lot of competition, finding the right niche market to focus on is the open to competition

10. You are not connected. These days, in the world of business, if you are operating on a virtual island, you are at a big disadvantage. You are defined, to some extent, by who you know, and if you do not possess a network of business connections and partnerships, it can negatively impact the value of your business. Not to mention, you can use your network to quickly locate a willing buyer.