- No Collateral Required

- No Personal Guarantee

- Quick Online Application

- Flexible - Automated Payback

- No Business Plan Necessary

- Bad Credit OK

Small Business Financing Up To $250,000.

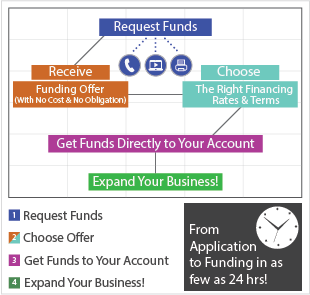

This section of FastUpFront covers Small Business Financing. Find information by industry or business type on various loan products compared to small business cash advance programs for expanding, modernizing, improving and maintaining small businesses.

Small Business Financing in the form of an unsecured business cash advance is available to companies processing more than $2500 per month in credit card sales for at least three months. Learn how a business cash advance can help to finance your small business without the hassles associated with loans offered by banks and other lending institutions.

Financing a small business with a business cash advance is ideal for businesses with little or no collateral, bad credit, or relatively new businesses with little financial history.

If you process at least $2500 in credit card invoices per month you can apply for an unsecured business cash advance of up to $250,000. Get started online now , or call Toll Free 1-888-878-6250 (1-888-UpTo-250K)

Small Business Financing by Industry / Business Type:

- Automotive � Small Business Financing

- Beauty Salons Loans and Financing

- Dentistry Business Financing

- Restaurant Loans and Financing

- Seasonal Businesses

- Fast Business Loans

- High Risk Business Loans

- Minority Business Loans

- No Collateral Loans

- Secured Business Loans

- Working Capital Loans

- Hotel and Motel Business Financing

- Bars and Nightclub Financing

- Alternative Business Line of Credit

- Construction Business Financing

- Franchise Business Financing

- Manufacturing Business Loan and Financing

- Healthcare Business Financing

- Retail Business Loan/Store Financing

- SBA (Small Business Administration Loan)

- Trucking Business Financing