The first decade of the 21st century is coming to end; it’s a decade that will undoubtedly be remembered for the recession-weary economy and strained consumer budgets that have grabbed the headlines over the past few years. But average consumers have not been the only ones trying to scrape by. Even before the emerging economic difficulties had been officially labeled a “recession,” State governments have been busy trying to bring in extra revenue to cover their growing deficits. Some of their efforts have been puzzling at best, downright weird at the other end, and often problematic for smaller businesses everywhere in between.

Here is a collection of over 20 of the most bizarre state taxes are either currently in effect or were considered over the past few years:

If You Can’t Beat Them… Tax Them!

Recognizing that taxing people’s vices can be quite a lucrative arrangement, state governments have been expanding their so-called “sin taxes.” Here are a few notable tax arrangements:

Fountain Soda Drink Tax

If you ever go to Chicago, buy your soda in a can. If you buy the drink from a fountain, you will end up paying a 9% tax. Buy the same soda in a bottle or a can, and it’s only 3%.

Candy Tax Confusion

In June of last year, legislation that made candy without flour taxable went into effect in Washington State. Shortly before the legislation was enacted, the Washington Department of Revenue posted a list online with some 3,000 items that would be subject to the tax. On the list were the likes of Three Musketeers, Starburst, and M&M’s, whereas candies without flour, including Twizzlers, MilkyWay and Nestle’s Crunch remained exempt. The law stirred up so much debate and confusion, however, that it was eventually repealed six months later.

Expensive Playing Cards

The price of a deck of playing cards will cost you 10 cents more in the state of Alabama thanks to a tax levied on the purchase of a deck that contains “no more than 54 cards.”

Illegal Drugs

Almost half of all US states enforce a tax on illegal drugs. That’s right, those who get their hands on some marijuana and other illegal substances are legally required to purchase and affix state-issued stamps on their stash. The total tax obligation is determined by the quantity of illegal drugs in possession. Though most of these taxes are “recouped” when the police make an arrest, people actually have the option of heading down to the State Department of Revenue and the paying the tax so they can receive stamps to affix to their illegal drugs! Not surprisingly, according to state records, takers are few.

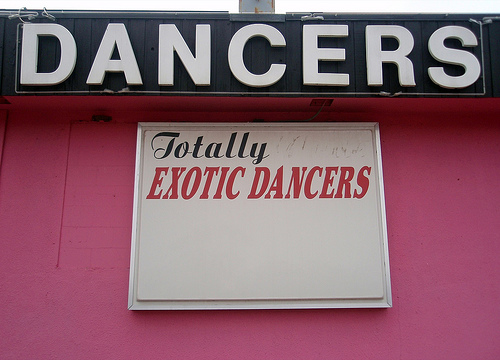

The Less They Wear, The More Your Fare

Several states including Texas, Utah, Florida, and New York, have already levied or are considering levying taxes on the patrons of gentleman’s clubs, exotic dance parlors and all other places where nude or partially nude people work. The body of legislation, known as a “pole” tax, first appeared in Texas in 2007, and has since generated some $13 million in revenue for the Lone Star State that is designated to fund sexual assault programs. There’s one small problem, however, a judge recently ruled that the tax limits the free speech of the strippers, exotic dances, and other “sex workers”and the matter has been turned over to the high courts. Currently, the money is sitting in an account pending the outcome.

(Image Credit)

The Brothel Tax

In March of 2009, a Las Vegas Democrat proposed tacking a $5 surcharge on every “date” within any of the state’s legalized bordellos- a move that would result in an estimated $2 million dollars in annual revenue. With numbers like that there’s little wonder why state officials would be eying this industry. Moreover, the Nevada Brothel Owner’s Association is in support of the tax and has for years volunteered to pay some sort of state fee, much like the state’s gaming industry. In the end, however, state lawmakers got cold feet and the proposal was dropped a year later.

(Image Credit)

What Were They Thinking?…

Travel Taxes

Last year, numerous states began to target out of town tourists and business travelers as a source of new revenue with a series of hotel taxes, car rental fees, and other travel-related charges. Popular tourist attractions, in particular, have taken a beating. Outraged travelers and small business owners have been quick to point out that all these impositions are coming at a time when travel should be encouraged.

Pennsylvania Taxes Air

According to the Pennsylvania Department of Revenue, sales from compressed air vending machines and vacuuming vending machines, those used to blow up tires and clean out cars, are both subject to sales and use tax.

Pet Tax

Residents of Durham County in North Carolina have to pay more for their fury friends. According to the Durham County Animal Ordinance, local cat and dog owners with pets four months or older are subject to a $10 tax per animal. If the pets have not been “altered,”the tax jumps to $75.

Go to Court, Get Taxed

In the State of Tennessee, adults involved in criminal or civil court proceedings may also end up having to pay a $25 litigation tax.

Skip the Meal; Just Get Dessert

In California, when it comes to the sales tax on food, cold foods are usually exempt from taxes, unless they are purchased from a vending machine. Foods that are usually prepared hot are taxable, unless you’re buying a fresh-baked item or coffee, which are both tax-exempt.

The Home of Double Taxation

In celebration of America’s independence, businesses selling sparklers, fire crackers and other related items have the privilege of tacking on a special 4th of July sales tax in addition to the 6% sales tax already in effect.

Tax the Rich; Steal from the Poor

Promoted as an effort to spread the distribution of wealth by making the rich pay their “fair share,” the State of Kansas is trying to bring in about $350 million a year by exclusively taxing high-end services including, limousine and hot air balloon rides, golf green fees, private landscaping, and professional laundry services. Opponents of the bill, however, raised concerns that the additional taxes will stifle the small businesses that provide these high-end services.

Hot Air Balloon Tax

In Kansas, a debate recently ensued regarding how to classify hot air balloon rides in order to determine if the pricey pastime should be subject to the state’s amusement tax. In the end, hot air balloon flights were exempted- but only if you have somewhere to go, even it is no where in particular. According to the Kansas Department of Revenue, “Under the Anti-Head Tax Act, 29 U.S.C. Section 40116, states and local jurisdictions are prohibited from imposing fees and charges on airlines and other airport users. The department determined that un-tethered balloon rides where the balloon is actually piloted somewhere “some distance downwind from the launching point” would be considered carrying passengers in air commerce and would be pre-empted by the law. However, state sales tax can be imposed on tethered balloon rides.”

Things That Make You Go Hmmm…

The Cost of Carving

If you go to buy a pumpkin in Iowa, Pennsylvania, or New Jersey in order to carve a Halloween jack-o-lantern you’ll pay sales tax; buy the same pumpkin to eat, and you pay nothing. What if you buy a pumpkin to carve, but what to roast it’s seeds to eat afterward?

One Last Tax Break

In the State of Ohio, if you go to a salon and have someone put makeup on you, the transaction is taxable; at a funeral parlor, however, the deceased can have their faces done tax-free.

The 100 Years Income Tax Deduction

Many people spend some of their retirement years working a small job on the side, whether to earn a little money or pursue a hobby. But in the State of New Mexico, there is even more incentive to work in one’s golden years: anyone 100 years and older is exempt from paying income tax; centenarians can also not be claimed as a dependent.

Sales Tax “Holiday’s Questionable List

In order to encourage spending, several states hold a “tax holiday” on school supplies and clothing at some point towards the end of the summer. Inevitably, some unusual items find their way on to this list. The State of Florida, for example, exempts bowling shoes, fanny packs, leg warmers, shoulder pads, ski suits, hunting vests, and adult diapers, but curiously leaves out staplers and computer paper. In Texas, football and baseball jerseys are tax exempt, but not pads, helmets, pants and other sports gear. Belts are exempt from the tax, but belt buckles are not. Cowboy boots and hiking boots are also tax free, but rubber boots and climbing boots remain taxable.

(Image Credit)

Don’t Drink and Drive… At Least Not in Colorado

The State of Colorado recently eliminated an exemption for non-essential food items and packaging provided with the purchase of food and beverages. Flash: cups are considered essential, lids are not.

Body Art Tax

If you live in the State of Arkansas the price of tattoos, body piercings and electrolysis is subject to a 6% sales tax alongside several other services, such as boat storage and pet grooming.

It’s an emergency? Let’s fly!

If you are in South Dakota and need an ambulance, you’ll pay tax for the service. However, if you should need air transportation to a far away medical center, your air ambulance flight is exempt.

The Bagel Tax

Some New York City residents were in an uproar recently when the city decided to enforce a tax law requiring bagel vendors to tack on an 8-cent fee for customers who ordered a sliced bagel. To make matters worse, adding toppings, such as cream cheese, increases the sales tax. So, say you buy a whole bagel, walk outside the shop, and start eating it on the street, it is exempt from tax. But, if you purchase that same bagel and eat it in the bagel shop (even without cream cheese), the vendor is required by law to add the sales tax to the purchase price. When the law was originally put into effect, many vendors chose to ignore it- that was until a city-wide audit struck 2,500 restaurants.

(Image Credit)