When it comes to the U.S. economy, sometimes it seems that everyone loves a good scapegoat- especially when the “everyone” is desperately trying to turn a blind eye to some ugly, fundamental problems…

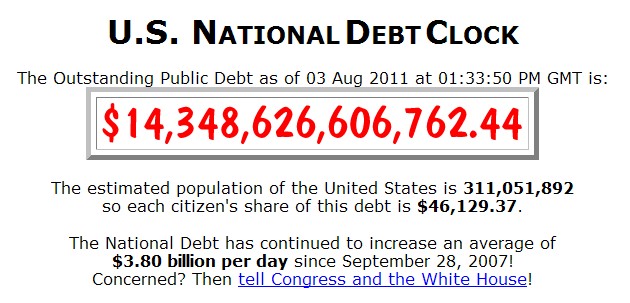

As economic analysts try to make sense out of Wall Street’s recent nose dive, there are so far several suspects in the line up: the recent credit downgrade, the uncertainty over the national debt and any legislation or changes in government spending connected to it, the growing debt crisis in Europe, and a series of rather weak economic indicators in the US, including the current GDP.

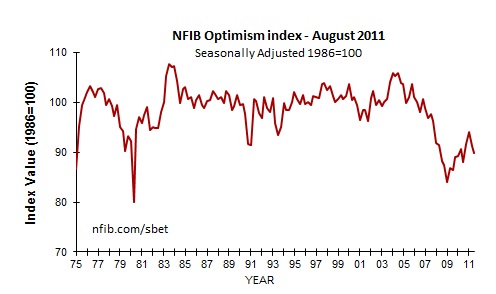

The most recent survey of Small Business Optimism conducted by the National Federation of Independent Business (NFIB) suggests deeper, more fundamental issues are at work here. What is particularly telling is the significant (and seemingly widening) divide between Big Corporate America and Main Street America. Here are some of the highlights of the survey:

- Though the national labor reports released at the end of last week indicate that the unemployment rate has dipped ever so slightly, it seems that the same is not true among small businesses in particular: “Twelve percent (seasonally adjusted) reported unfilled job openings, down 3 points. Over the next three months, 10 percent plan to increase employment (down 1 point), and 11 percent plan to reduce their workforce (up 4 points), yielding a seasonally adjusted 2 percent of owners planning to create new jobs, 1 point lower than June, leaving the prospect for job creation bleak.”

- According to the survey, revenues among small businesses have continued their sluggish trend: “The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past 3 months lost 1 percentage point, falling to a net negative 8 percent. Currently, there are more firms with sales trending down than there are with sales trending up…”

- Likewise, the majority of small businesses report stagnant or diminishing sales: “Reports of positive earnings trends were unchanged at a net negative 24 percent of all owners… Corporate profits are at a record high level as a share of GDP, but these increased have not translated to Main Street, where even among the most optimistic of sectors, small manufacturing firms, only 23 percent reported higher earnings while 37 percent reported lower profits (not seasonally adjusted).”

- Investment in growth, expansion, including standard equipment and facility upgrades remains weak even among many financial incentives: “The frequency of reported capital outlays over the past six months was unchanged at 50 percent of all firms, [and] the percent of owners planning capital outlays in the next three to six months fell 1 point to 20 percent, a recession level reading that has typified the recovery to date…”

- With all of the above factors, it’s not surprising that optimism among small companies is not so high: “The net percent of owners expecting better business conditions in six months was a negative 15 percent, down 4 points and 25 percentage points lower than January.”

With unemployment still lingering at all-time high’s and consumer confidence still languishing, how are so many big corporations pulling in such record profits? The answer is that many of these businesses are cutting costs by letting go of “expensive” domestic workers, closing down stores and factories, and actively seeking cheaper, foreign labor as well as expanding operations in emerging foreign markets. Of course these tactics seem to be fueled by a desire among corporation owners and top management to keep their coffers full and make Wall Street happy

None of this helps the American economy much, and in fact it can be a big reason why the nascent “recovery” seems to have so quickly sputtered and stalled. Less people employed = less people to buy goods and services. Period. We can expect difficult times ahead until Big Corporations and Small Businesses are pretty much going in the same direction. As of yet, that gap is getting harder and harder to bridge.