In an effort to simplify accounting for small business owners, the American Institute of Certified Public Accountants (AICPA) recently released an easier way for small and medium size business owners to create financial statements for any interested party (managers, banks or investors) an improved way to view a company’s finances.

In an effort to simplify accounting for small business owners, the American Institute of Certified Public Accountants (AICPA) recently released an easier way for small and medium size business owners to create financial statements for any interested party (managers, banks or investors) an improved way to view a company’s finances.

What does it do?

The new model was created for private, for-profit businesses (so not GAAP compliant) and won’t help you file taxes. Rather, it gives reliable financial statements—for business owners, lenders and bonding companies (for construction businesses). It is meant to be more comprehensive than tax or cash accounting and additionally designed to create a single format all small and medium size businesses can use. In practical terms, the new framework uses historical costs versus fair-value estimates and gives business owners the ability to adapt and produce a financial statement appropriate for their needs. There is also the hope that as more businesses adopt the new framework, more reliable information about small and medium sized businesses and therefore make it easier for those business owners to compare their growth to others.

Who is it for?

According to Entrepreneur.com, the standards are for private companies with $300,000 to $100 million in annual revenue. Bob Durak, Director of Private Company Financial Reporting at AICPA said, “What we hear when we talk to these small businesses and the CPA’s that serve them is that they are looking for another option. These new standards are likely to be used by owner-managed firms that don’t have an in-house accounting team. If a company expects to go public in the near-term, it may want to avoid these non-GAAP accounting principles.”

Do I have to use it?

At the moment the format is completely optional. However, there is also the hope that as more businesses adopt the new framework, more reliable information about small and medium sized businesses and therefore make it easier for those business owners to compare their growth to others. However, to gain that kind of acceptance it will need the blessing of accountant and bank lenders. That might not be as easy as the AICPA thought.

Last month, the Institute of Management Accountants (IMA) released a statement announcing their opposition to the AICPA option. According to their press release, “An accounting association body [in this case, the AICPA] should not be setting what could be perceived as authoritative standards, which in fact are non-authoritative and thus difficult to regulate or enforce…Private companies need to maintain credibility with sound internal controls while maintaining the freedom to innovate and create sustainable value for stakeholders. However, it is IMA’s assertion that businesses should not risk that credibility by adhering to a framework created by a group other than a national standard-setting entity.”

For More Information

Talk to your CPA or visit the AIPCA site.

Change is a-coming on the health care front. Obamacare is making sure of that. Otherwise known as the Patient Protection and Affordable Care Act, this 2400-page bill, passed into law in 2010, is confusing and worrying an awful lot of small business owners.

Change is a-coming on the health care front. Obamacare is making sure of that. Otherwise known as the Patient Protection and Affordable Care Act, this 2400-page bill, passed into law in 2010, is confusing and worrying an awful lot of small business owners.

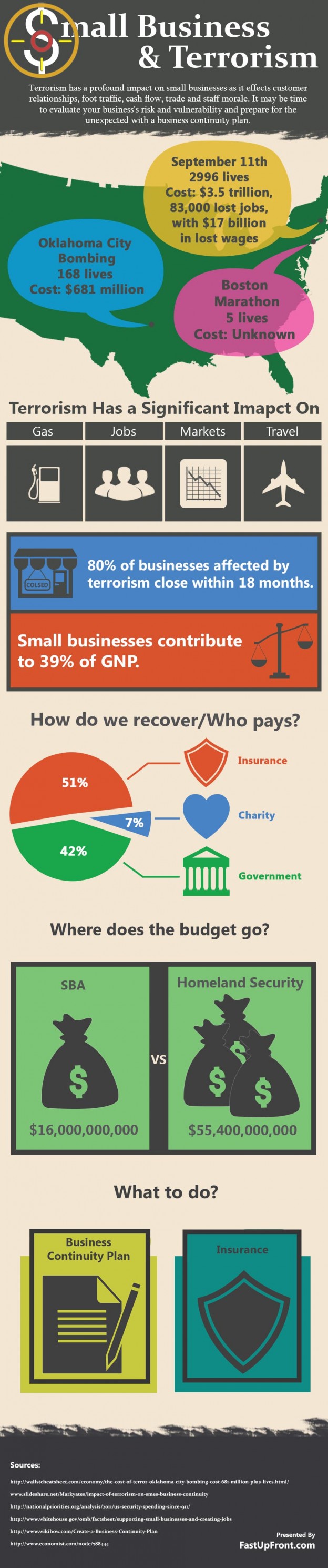

![Terrorism and Small Business [ infographic ]](https://www.fastupfront.com/images/FastUpFront-2013.jpg)