With the new year underway, you may have an urge to just put your head down and plow forward- especially if 2012 didn’t treat you or your business so kindly. But, one of the biggest mistakes that we on a societal level tend to make is that we fail to apply the lessons of the past (even the recent past) to our present and future. The result is that we can make fatal errors in judgment and behavior that could have easily been prevented. Our desire to move on only trips us up later on.

That said, here are ten defining moments in business that occurred in 2012. Each event represents an important transition or trend that will no doubt shape 2013, and as such, should be kept in mind as we head into the new year.

1. Big banks settle on mortgage falsification reports. In February of 2012, 17 of the biggest banks in the US, including Bank of America, HSBC, and Morgan Stanley, collectively agreed to pay $25 billion to settle allegations by state and federal officials that they used falsified documents to evict homeowners facing foreclosure. Many critics of the deal pointed out, however, that the real perpetrators of the mortgage meltdown were basically getting off scot free, paving the way for some other, future financial crisis.

1. Big banks settle on mortgage falsification reports. In February of 2012, 17 of the biggest banks in the US, including Bank of America, HSBC, and Morgan Stanley, collectively agreed to pay $25 billion to settle allegations by state and federal officials that they used falsified documents to evict homeowners facing foreclosure. Many critics of the deal pointed out, however, that the real perpetrators of the mortgage meltdown were basically getting off scot free, paving the way for some other, future financial crisis.

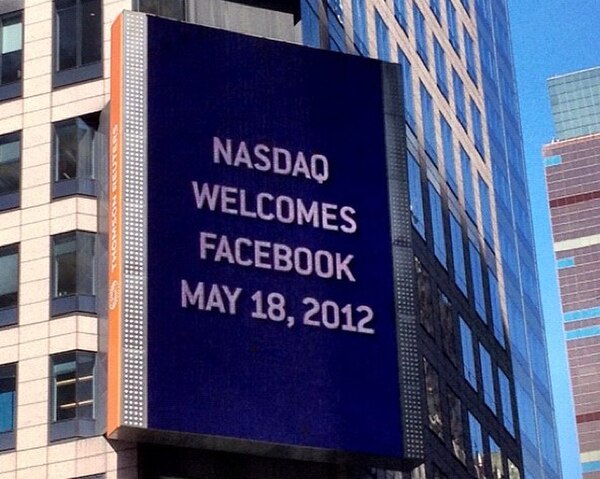

2. The fateful Facebook IPO fail. One of the most ballyhooed tech IPO’s of the decade, ended in a colossal fail. The stock’s May offering was marred by technical glitches and chaotic trading, but that was just the start of the stock’s woes in 2012. The company’s share prices plummeted after its $38 debut, trading below $20 in August. The stock has remained well below its IPO throughout the year. Industry analysts claim that the stock’s poor performance, coupled with a string of high profile tech let-downs (think Groupon, Zynga, etc) has spooked VC investors, making it more difficult for Silicon Valley startups to get financial backing.

2. The fateful Facebook IPO fail. One of the most ballyhooed tech IPO’s of the decade, ended in a colossal fail. The stock’s May offering was marred by technical glitches and chaotic trading, but that was just the start of the stock’s woes in 2012. The company’s share prices plummeted after its $38 debut, trading below $20 in August. The stock has remained well below its IPO throughout the year. Industry analysts claim that the stock’s poor performance, coupled with a string of high profile tech let-downs (think Groupon, Zynga, etc) has spooked VC investors, making it more difficult for Silicon Valley startups to get financial backing.

3. Global economic slowdown. With all the turmoil among the European Union and a tepid U.S. economic recovery, strong growth among developing countries had been a persistent bright spot. But that began to change as emerging markets like China faced a manufacturing slowdown and India began its battle with inflation. In July, the International Monetary Fund lowered its forecasts for global growth further fueling fears of a word-wide economic slowdown.

3. Global economic slowdown. With all the turmoil among the European Union and a tepid U.S. economic recovery, strong growth among developing countries had been a persistent bright spot. But that began to change as emerging markets like China faced a manufacturing slowdown and India began its battle with inflation. In July, the International Monetary Fund lowered its forecasts for global growth further fueling fears of a word-wide economic slowdown.

4. Natural disasters. The U.S. saw a one-two punch of natural disasters this year. In the hot summer months, drought gripped the Corn Belt and more than half the United States, reaching proportions not seen in more than 50 years. Rising crop prices and a drop in farm inventories have cost the economy an estimated $50 billion. Later this past year, Hurricane Sandy whipped through the eastern seaboard, devastating coastal New Jersey and submerging lower Manhattan in several feet of water. Both disasters have raised serious issues about climate change and emergency preparations.

4. Natural disasters. The U.S. saw a one-two punch of natural disasters this year. In the hot summer months, drought gripped the Corn Belt and more than half the United States, reaching proportions not seen in more than 50 years. Rising crop prices and a drop in farm inventories have cost the economy an estimated $50 billion. Later this past year, Hurricane Sandy whipped through the eastern seaboard, devastating coastal New Jersey and submerging lower Manhattan in several feet of water. Both disasters have raised serious issues about climate change and emergency preparations.

5. Quantitative easing continues. The Federal Reserve announced a third round of quantitative easing in September to stimulate the economy and reduce unemployment. For the first time, it made a definitive promise that it would keep interest rates ultra-low even if the economy starts to recover. Critics of the plan claim that the move only helps the big corporations and banks pad their coffers- since they can borrow money for next to no cost. Consumers, however, get little return on their savings (unless they invest in the volatile stock market), and the majority of small business owners, still struggling with sluggish sales, have little need for cheap financing. In short, the plan is hurting the economy, not helping it.

5. Quantitative easing continues. The Federal Reserve announced a third round of quantitative easing in September to stimulate the economy and reduce unemployment. For the first time, it made a definitive promise that it would keep interest rates ultra-low even if the economy starts to recover. Critics of the plan claim that the move only helps the big corporations and banks pad their coffers- since they can borrow money for next to no cost. Consumers, however, get little return on their savings (unless they invest in the volatile stock market), and the majority of small business owners, still struggling with sluggish sales, have little need for cheap financing. In short, the plan is hurting the economy, not helping it.

6. Standing at the edge of the Fiscal Cliff. Right after President Obama was reelected, the nation turned its attention to the series of year-end tax hikes and automatic spending cuts known as the “fiscal cliff.” Though a last minute bipartisan “solution” was reached shortly after the close of 2012, the legislation effectively postpones our free fall of the fiscal cliff and makes it a de facto issue in 2013.

7. Black Thursday. This year, retailers broke with the tradition of giving thanks and eating turkey to offer bargain hunters a head start on their holiday shopping. Walmart, Target and other stores had shoppers lining up on Thanksgiving night to take advantage of Black Friday sales. Though workers staged protests, and many consumer finance experts pointed out that most of these Black Friday sales would be available later in the shopping season, the shopping continued in spite of it.

7. Black Thursday. This year, retailers broke with the tradition of giving thanks and eating turkey to offer bargain hunters a head start on their holiday shopping. Walmart, Target and other stores had shoppers lining up on Thanksgiving night to take advantage of Black Friday sales. Though workers staged protests, and many consumer finance experts pointed out that most of these Black Friday sales would be available later in the shopping season, the shopping continued in spite of it.

8. Same day delivery. The past year also saw the push (and execution) of same day delivery services by mega-retailers, Amazon, Walmart, and even eBay. The move, puts greater pressure on small local retailers and other small businesses to offer their customers a reason to shop at their establishments.

8. Same day delivery. The past year also saw the push (and execution) of same day delivery services by mega-retailers, Amazon, Walmart, and even eBay. The move, puts greater pressure on small local retailers and other small businesses to offer their customers a reason to shop at their establishments.

9. Small business owner pessimism. The whole past year has been characterized by a declining small business optimism. With issues like the fiscal cliff, health care reform, increasing competition from big businesses, and a weak economy, it’s little wonder why.

9. Small business owner pessimism. The whole past year has been characterized by a declining small business optimism. With issues like the fiscal cliff, health care reform, increasing competition from big businesses, and a weak economy, it’s little wonder why.

10. U.S unemployment rate finally drops. The U.S. unemployment rate dropped to its lowest point in nearly four years in September, reaching 7.8 percent. This year also saw a modest growth in wages earned. So far, the employment numbers have held steady through the year’s end.